On “Television Fatigue” and Off Weeks…

[NOTE: This is the final scheduled entry (or one of the final entries...) regarding out-of-race, macro-scenario features. In the future, I'll post further analysis on in-race characteristics and their effects on NASCAR's popularity. For example, I'll research caution patterns, competition and parity, and various drivers' impacts on television ratings. You can always send me your ideas for research, too -- and .]

I don’t ever “hunt” for research questions. Rather, I examine the events surrounding me and study them further. This post depicts that existentialist approach. After FOX wrapped it portion of television coverage for 2013, I wondered how their showing consecutive races for four months affects NASCAR’s television ratings annually. I opine that holding so many events in-a-row on the same network impacts the average television rating negatively (I call this “television fatigue”). And with the current off weekend for the Cup Series, I also desire to know the impact that a week off has on the next event’s audience. So those are the objectives for this brief entry — how do consecutive races shown on the same network and off weekends affect NASCAR’s television ratings?

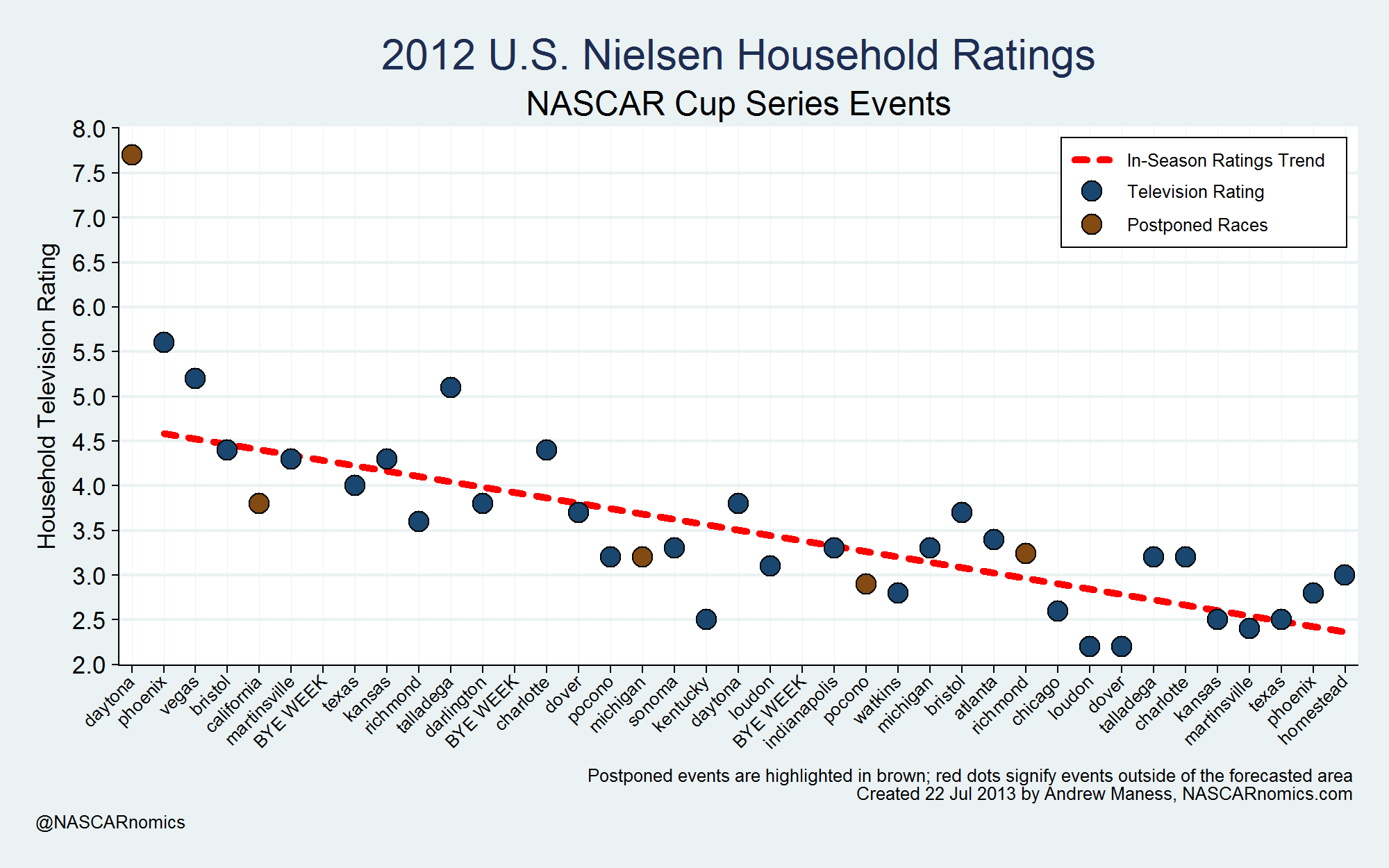

The size of NASCAR’s audience dwindles as the year progresses — the Daytona 500 becomes a distant memory and the weekly grind generally lends fewer fans of the Cup Series. To visualize this phenomenon, I attach last year’s television ratings:

The dotted red-line displays the downward trend of NASCAR’s television ratings throughout the season. How much of that season-long decline is due to FOX, TNT, and ESPN/ABC’s showing a large glut of races in a single time-span every year? And how much of that decline is simply due to fewer people’s tuning-in due to a lengthy season?

This is where statistical regression comes in handy — I can model and separate these various impacts on television ratings to determine exactly how much of the in-season decline comes from a long schedule and how much originates from a television station’s showing several races in a row. To simulate these effects, I create a characteristic called “consecutive races.” This variable simply indicates how many events in-a-row a particular network hosts. For example, FOX’s coverage at Dover this season carries the value of 13, as it hosts the channel’s thirteenth consecutive race of the season. This week’s event from Indianapolis is equal to 1 since it’s the first of several telecasts in a row for ESPN/ABC. So what exactly happens when I include this effect within the ratings model? I examine the differences between my main predictive model and the one including “consecutive races”:

I post my main model on the left. It explains and accounts for over 90% of the variance in television ratings. The regression model which includes the “consecutive races” characteristic is on the right. For convenience, I highlight relevant lines for discussion. Here are the key points from all of those numbers:

- “Consecutive races” carries a -0.005 for its coefficient. This means that with each weekly event a network shows, the channel loses 0.5% of the audience from the prior week. Although this variable is statistically significant (that is, one is confident that the variable negatively affects the television rating), the magnitude is very small. For example, a race that earns a 4.0 at the start of a television network’s portion of the Cup schedule would still receive a 3.8 if it were the channel’s twelfth consecutive race, all other features in the model held constant { 4 * [ 1 + ( 12 * -0.005 ) ] }.

- The “month” variable changes an insignificant amount when I account for consecutive races on a network. All race characteristics held equal, “schedule fatigue” (the loss of viewership due to a relatively lengthy season) still exists when I test my “consecutive race” theory. The only way to mitigate this negative effect, obviously, is to condense the season into fewer months.

- There exists a change in how much various television contracts have affected the television audience size. When I account for races being shown on the same network consecutively, the impact of a centralized television contract is greater than in the main model. Centralizing the Cup Series schedule to mostly network television in 2001 results in ratings that are almost 42% better than in the late 1990s (that surge in ratings is only 34.5% in the main model).

There is a price, however, in the expanded audience elaborated in the third point (which explains the discrepancy between the two models). The cost of centralizing the schedule, of course, is that each network loses a small portion of its weekly audience every race, ceteris paribus. That cost was much lower in the late 1990s; no single network ever hosted more than six consecutive races. But that cost — the “consecutive races” penalty of -0.5% per event — is so minimal, that NASCAR’s tapping networks to air many races in a row is a winning strategy. It provides continuity with NASCAR’s television partners throughout the year. Fans and casual viewers generally know when and on what channel a race starts nowadays relative to fifteen years ago. Although television stations shed a small number of their viewers from week-to-week, that marginal cost is heavily outweighed by the marginal benefits associated with centralizing the schedule, all else being equal.

Now what about those off weeks? How have they changed NASCAR’s popularity over time? After accounting for several variables that might improperly influence my results, I list the following table to compare “bye-week” races to “regular” events:

The final column indicates the percent change in rating if an event were hosted immediately after an off-weekend. As the reader notices, bye weeks never really influence the normal household rating for many years in my sample. In this current contract, however, the television rating exhibits a small increase when NASCAR’s top series returns from a week off, ceteris paribus.

The series’ schedule evolves in a manner that leads to this effect. In the 1990s, NASCAR had several open weekends throughout the year (as many as nine over thirty-two races in 1997). It was almost normal to have a weekend off at least once per month. Recently, however, the sanctioning body reduces the number of off-weeks to a mere three per season. As such, NASCAR now provides a culture in which competing on every weekend is routine. And when a Cup race doesn’t take place, the anticipation for the next event builds. With more anticipation from the off weekend, I theorize that viewing the next race becomes a greater priority for some households; which leads to slightly higher ratings (roughly 3.8%) for races following off weekends under the current contract.

So what do you think? Why are races taking place on the heels of an off weekend performing strongly nowadays? Do you like having a block of the Cup Series schedule aired by just one network? Or do you prefer the de-centralization that occurred prior to 2001? Feel free to tweet or e-mail your opinions, critiques, and questions to me — and .

Thank you for reading!

Andrew